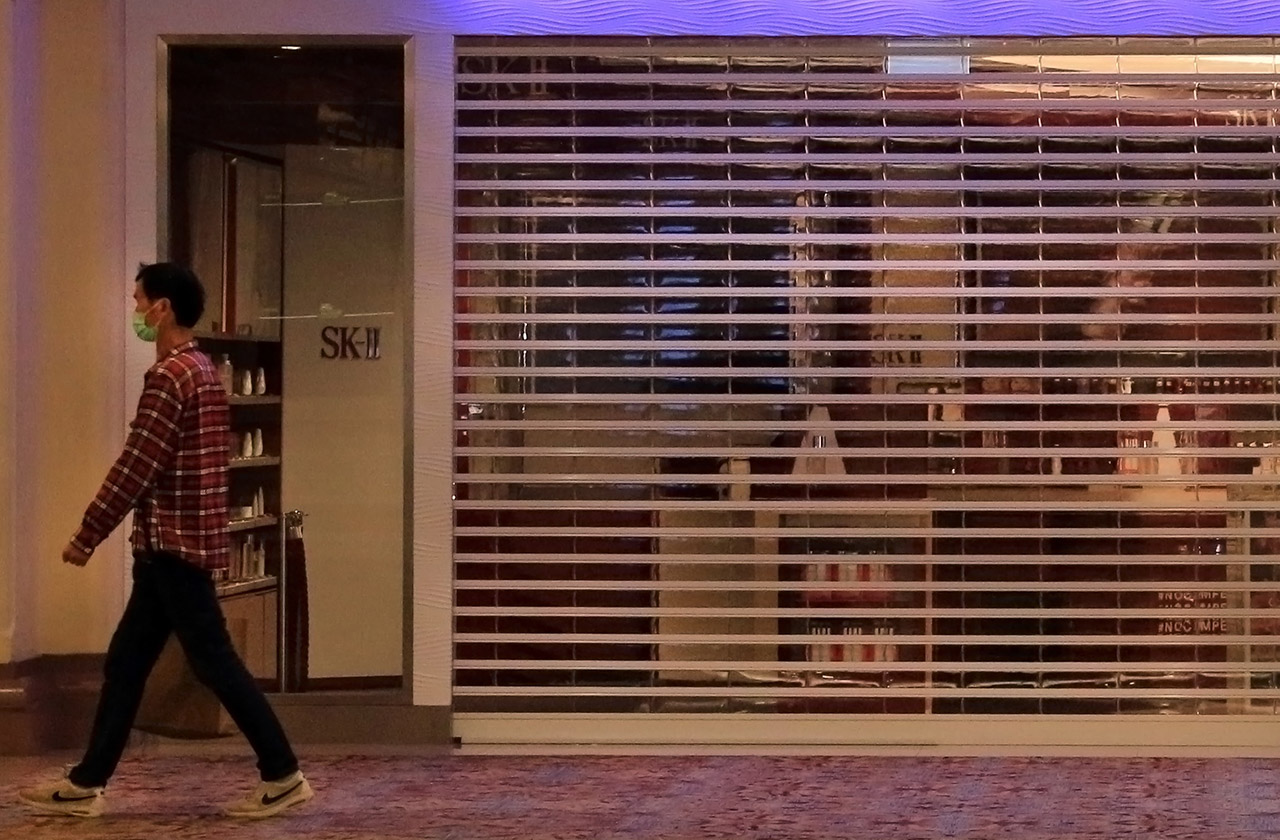

One in ten retailers facing collapse as economic damage accumulates

One in ten businesses in the wholesale and retail sector (9%) are facing imminent collapse as they state they will not survive another month of the lockdown, according to the latest wave of the Opinium-Cebr Business Distress Tracker.

As the Coronavirus continues to affect every sector and worker in the country, the latest edition of the Business Distress Tracker helps us assess the continuing challenges facing British businesses and their ability to carry on until the economy returns to some semblance of normality.

Tracking the data wave to wave allow us to understand the direction of travel for the economic and UK businesses, and despite the incredibly difficult time many are facing the silver lining is that conditions have not declined any further and some are improving their operations within the confines of lockdown. In particular, as consumers adapt to life in lockdown, B2C businesses have taken tentative steps to bring some of their staff off furlough.

Business insolvency risks

Insolvency risks for the business community as a whole appear to have receded marginally, with nearly 3 in 5 (58%) of businesses indicating that they are safe from insolvency as a result of coronavirus-related disruption. However, 9% of firms – amounting to 510,000 – remain at a high risk of going insolvent as a result of the current crisis.

Eight weeks after the national lockdown was introduced, many businesses are now on the cusp of closure. 5% of firms surveyed indicated that they could not survive another month if trading conditions remain as they are currently. The situation is particularly dyer in the wholesale & retail sector, where nearly one in ten (9%) of businesses do not think they can survive another month of lockdown.

The Opinium-Cebr Business Distress Tracker checks the pulse of the UK business community on a fortnightly basis, as firms across the country grapple with the unprecedented challenges brought about by the coronavirus crisis. The Tracker is based on a survey of 500 business across the country, representing a broad range of industries and business sizes.

Trading conditions and employment impacts

Though there has been a slight decline in the number of businesses making workplace adjustments, over four fifths (84%) of UK businesses continue to make changes to their operations. Positively, there has been a small reduction in the average number of employees on furlough (32% down from 35%), though the number of staff facing reduced hours (33% up from 32%) and wage cuts (34% up from 33%) have increased very slightly.

Most noticeably, B2C businesses have appeared to turn a corner. In our first wave at the height of lockdown two thirds (67%) said their trading conditions were poor, but this has dropped by 8 percentage points to 59% in our latest wave. Although they remain in incredibly difficult circumstances, it suggests both business and consumers have improved their ability to navigate their way through the lockdown measures. This has resulted in B2C businesses reducing the proportion of their staff on furlough (30% down from 36%) or with wage cuts (36% down from 41%).