New York City: Financial Wellbeing & Intersectionality

For Opinium’s inaugural New York State of Mind Survey, we asked 1,000 New Yorkers (across all 5 boroughs) about their experiences living in what many call “the greatest city in the world.” Twice yearly, our team will dig deep into what New Yorkers think, feel, and do. This enables us to understand the most exciting and urgent issues facing New Yorkers today.

Here, we explore one of the most critical concerns that came to light in the survey: financial wellbeing in New York City. This report provides a deeper dive into our findings on this topic and focuses on how New Yorkers of various racial, ethnic, and gender identities experience disparate levels of financial stability in the city.

Financial wellbeing is stratified by race and gender in New York City

New Yorkers are struggling to keep up with the rising cost of living. One in ten (10%) New Yorkers report struggling to afford basic necessities such as food, medical care, or rent. Nearly a fifth (18%) report that money is tight and that they would struggle in the face of an unexpected expense. Only 14% of New Yorkers report feeling financially secure for the long-term. White New Yorkers are the most likely to report feeling financially secure (22%) – feelings of financial security drop among Black (13%), Asian (11%) and Mixed race (6%) New Yorkers.

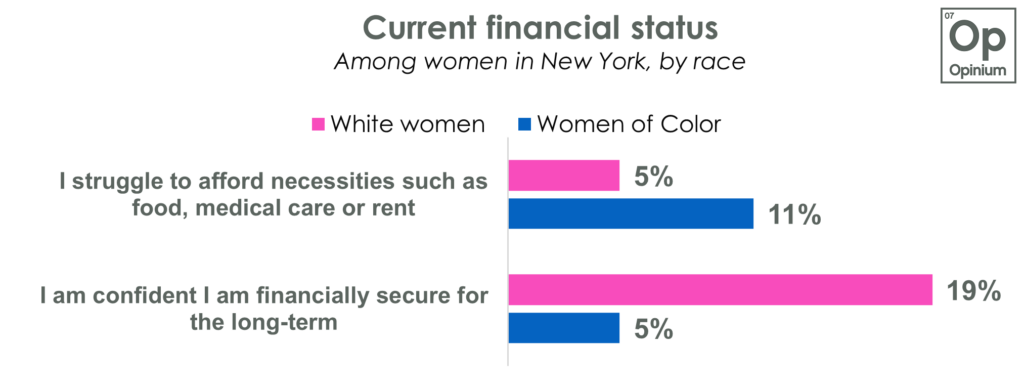

White men are more than 5x as likely to be financially secure than non-white women

A fifth (19%) of white women report being financially secure for the long-term, compared to 5% of women of racial minorities. Similarly among males, 26% of white men report being financially secure for the long term, compared to 14% of men of racial minorities. Overall, men are nearly twice as likely (19%) to report being financially secure for the long-term compared to women (10%) in New York

A similar disparity exists between Hispanic and non-Hispanic New Yorkers. 16% of non-Hispanic New Yorkers report being financially secure for the long-term, compared to 10% of Hispanic or Latino New Yorkers. Parallel to disparities between white and non-white women, Hispanic women are slightly less likely to be financially secure (8%) than non-Hispanic women (11%). This gap widens between Hispanic and non-Hispanic men – 12% of Hispanic men report being financially secure, compared to 21% of non-Hispanic men. Overall, women of racial and ethnic minorities are least likely to be financially secure in New York.

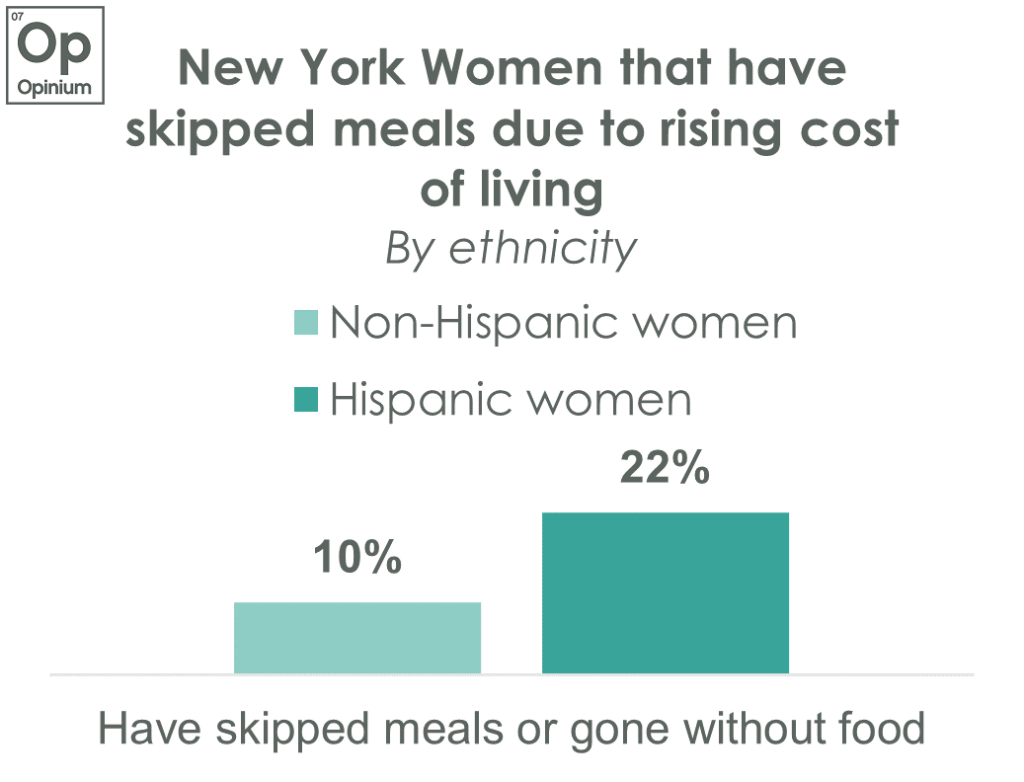

Hispanic women are more likely to experience rising housing costs and food insecurity

Eight in ten (81%) of Hispanic women in New York are experiencing rising housing costs, compared to 67% of non-Hispanic women. Furthermore, over a fifth (22%) of Hispanic women report skipping meals in response to the rising cost of living, compared to 10% of non-Hispanic women in New York.

Minoritized women least likely to be able to comfortably afford their housing

Nearly one in three (28%) New Yorkers are uncomfortable affording their current housing. Half (51%) of New Yorkers report being able to comfortably afford their current housing – a figure that rises to 61% among white New Yorkers, and 66% among white male New Yorkers. In comparison half (49%) of males of racial minorities can comfortably afford housing. Three in five (57%) of white female New Yorkers are comfortable affording their housing, compared to 44% of women of racial minorities.