Investor Voice: Q3 2025

Investment Performance

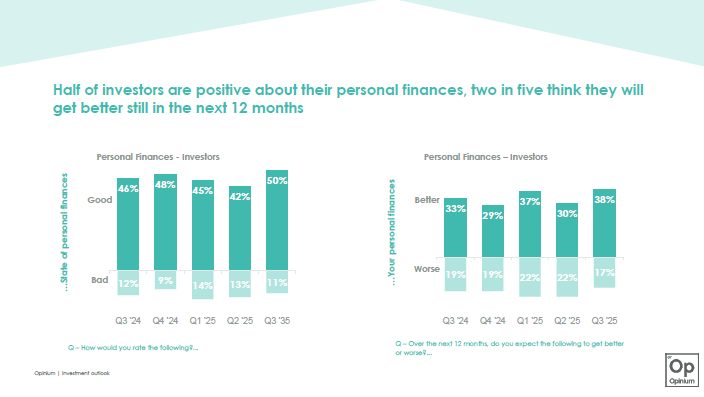

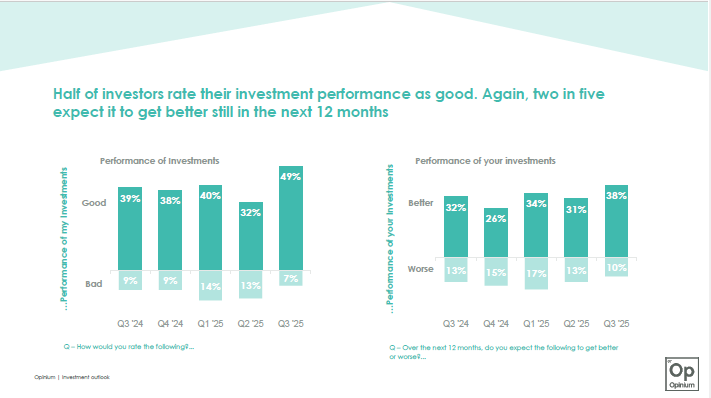

Investors are both positive about their personal finances (now and for the next 12 months), and positive about the performance of their investments (now and for the next 12 months). Outlooks have recovered since the tumultuous start to the year (US Liberation Day Tariffs).

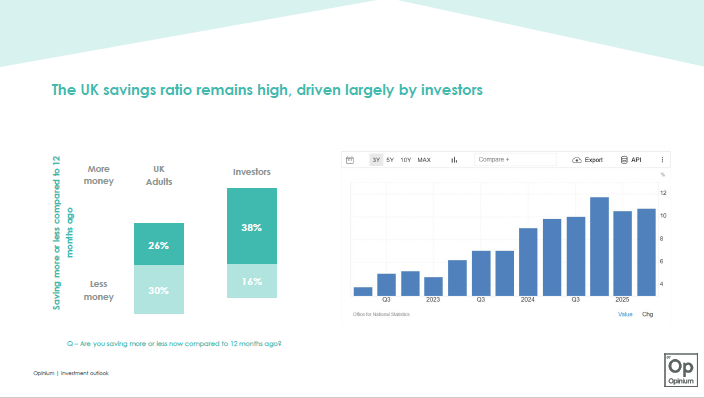

Appetite For Saving

The UK savings ratio remains high (ONS data). We find that this is driven mainly by the ambitions of UK investors, with two in five expecting to save more in the next 12 months (compared to a quarter of UK adults overall).

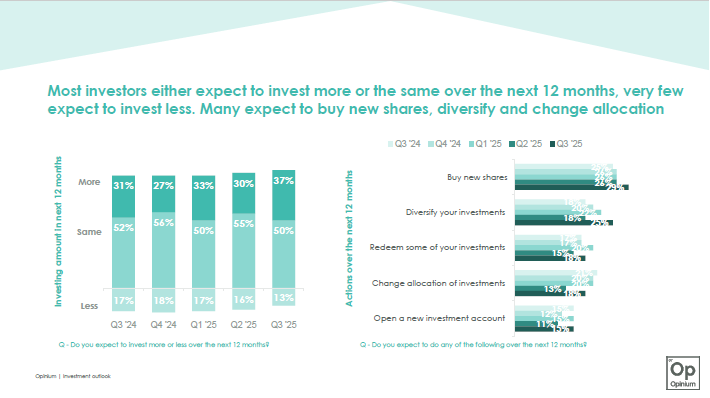

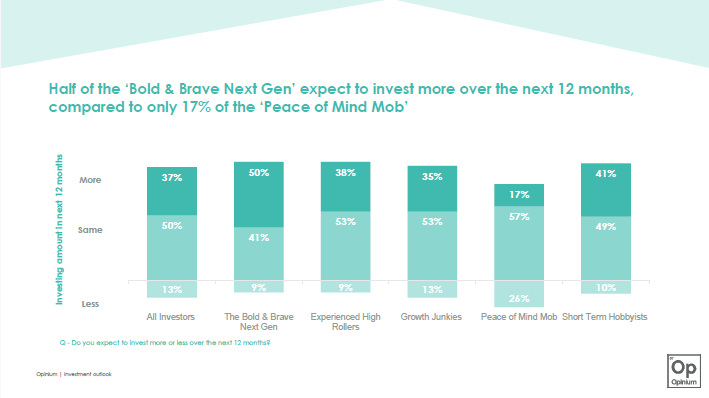

Almost all investors either intend to invest more (37%) or invest the same (50%) over the next 12 months. There has also been an increase in those saying they intend to buy new shares (29%) and open new investment accounts (15%).

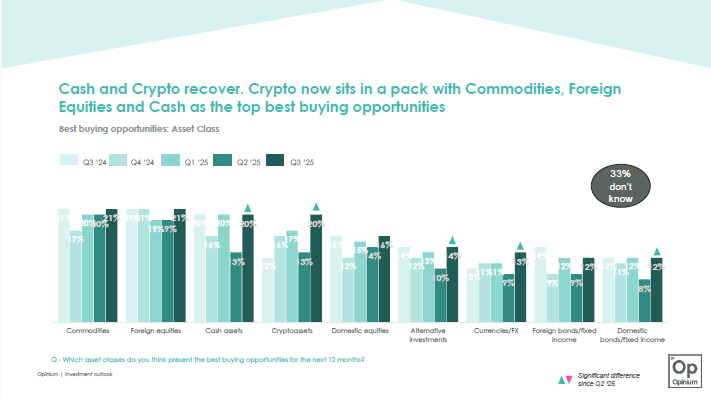

Best Buying Opportunities

The UK remains seen as offering the best buying opportunity. We have to go back to 2024 to see the US top the table. China has also jumped up the rankings to joint 3rd with the Emerging Markets (both 19%), leapfrogging Europe (excluding UK).

There has also been a large growth in investors saying Crypto Assets offer a best buying opportunity (20%). Crypto joins Commodities (21%), Foreign equities (21%) and Cash (20%) in the leading pack.

Tech dominates in terms of the best buying sector opportunities (36%, up from 32% in Q2). There is clear daylight between tech and energy (23%) as the next nearest sector.

In Spring 2025 Opinium launched its Investor Tribes segmentation, click here for details: Investor tribes – Opinium

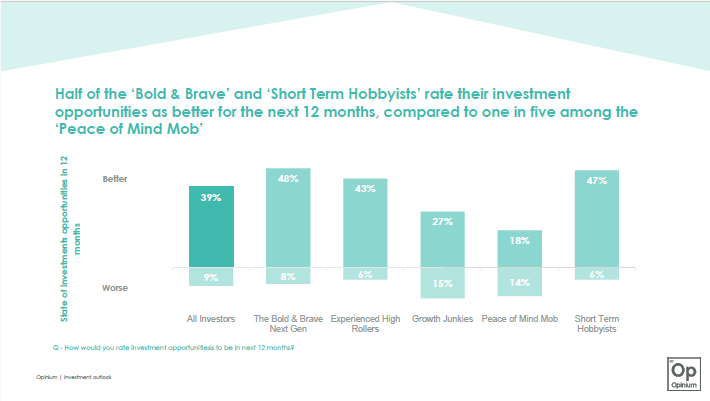

The segmentation split investors into 5 broad tribes (‘Growth Hunters,’ ‘The Brave & Bold Next Gen,’ ‘The Peace of Mind Mob,’ ‘Short Term Hobbyists,’ and ‘Experience High Rollers’). We were able to overlay the segments into our Investor Voice survey to see how the segments would respond to the Investor Voices survey questions.

As we might expect, the ‘Bold & Brave’ tribe and ‘Hobbyist’ tribes rate their own investment opportunities as getting better in the next 12 months, whereas the ‘Peace of Mind Mob’ were much more conservative.

Looking at their ambitions for the year, the ‘Bold & Brave’ tribe were much more likely to expect to invest more in the next 12 months. While again, the ‘Peace of Mind Mob’ were less likely to expect to invest more in the next 12 months.

Download the full report here: