They say grocery shopping has changed, but has it?

They say grocery shopping has changed, but has it?

As the cracks start to show in the Tesco empire, and the discounters continue to challenge the stranglehold that the big 4 supermarkets have enjoyed over the UK grocery £, we are constantly being told by the media that the way we buy our groceries, and who we?re buying them from, is changing.

But is it really? Are there fundamental shifts in purchasing habits or are these just short term trends?

Challengers vs. the big four

Shore Capital analyst Clive Black cites the recession of recent years as the key catalyst for consumers being driven away from the big four and into the door of the challenger supermarkets, stating that ?in the last 5 years middle England has had to find money and that has changed the way they shop?.

Graham Ruddick, retail editor at the Telegraph, takes a different view on recent retail changes and highlights the fact that the big four just got it wrong. Over expanding their retail capacity whilst pushing consumers to buy online has led to costly store closures. This, coupled with a desire to push their own label products, has opened the door for the strongly improved offering from Aldi & Lidl.

Either way, there is no denying that, amid the store closures, poor results and media scandals of the traditional supermarket heavyweights in the UK, there has been a steady rise popularity, and with thus a rise in fortunes, of the challenger supermarket brands.

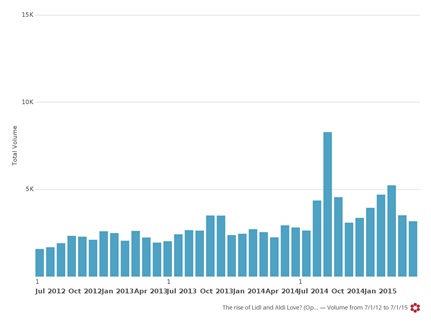

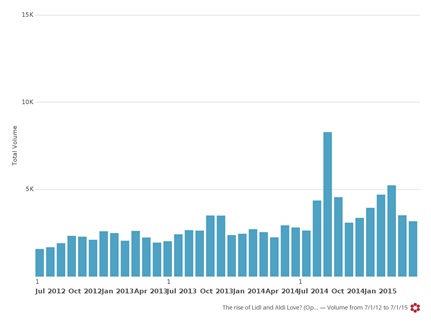

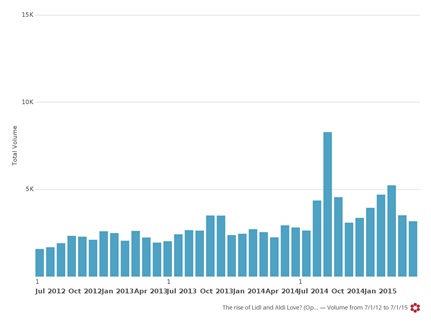

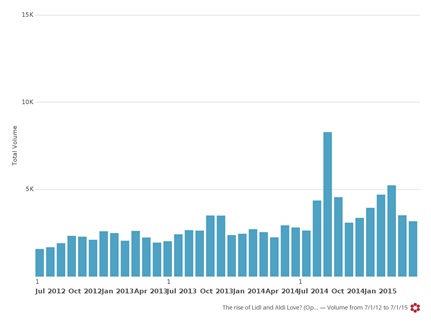

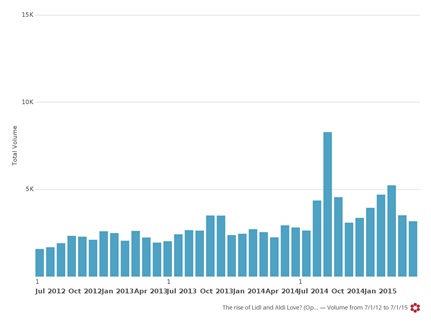

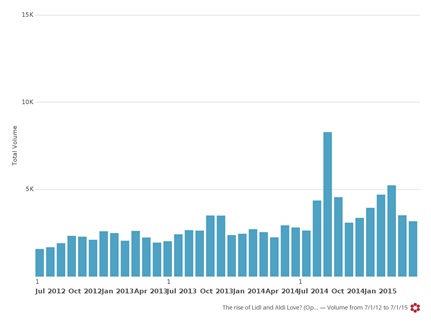

The below graph, provided by social media analytics platform Crimson Hexagon, shows a steady growth in positive Aldi and Lidl social media mentions since 2012.

The spike of positive mentions registered in October 2014 corresponds to Lidl?s ad response to Morrison?s price match offer.

The below topic wheel reinforces the ?rise of Aldi and Lidl love? seen over the past three years, showing frequent and prevalent themes in a social media conversation surrounding the two discounters. The inner ring represent frequently used terms and the outside ring provides a more granular look at words and terms and how they relate to the topics of conversation.

And, whilst Lidl has a little way to go in terms of its social media outreach, the below graph reveals that Aldi?s online share of voice is second only Tesco. This is significant, given that 93% of shoppers? buying decisions are influenced by social media according to Socialnomics, and a recent survey by DigitasLBi revealed that 35% of UK social media users share their in-store purchases via social.

By no means are Tesco, Asda, Sainsbury?s and Morrisons out of the game (in fact, the price war among the big four has encouraged consumers to spend more with each supermarket). But as the challengers plan to open up more stores and spend more on marketing than the rest of the industry put together, Aldi and Lidl will continue to shake up the grocery market and re-shape consumer behaviour.

Online vs. In-store

Screaming toddlers, long queues and heavy shopping bags ? just a few of the reasons to avoid setting foot in a supermarket aisle and do the weekly shop online. But have we really gone digital when it comes to grocery shopping?

Our consumer research tells us that 73% of shoppers haven?t changed their frequency of conducting a main shop in store over the last 12 months (21% said they were doing this less frequently than 12 months ago).

This does not represent a sea change in consumer behaviour, a conclusion backed up by online?s market share still being relatively small.

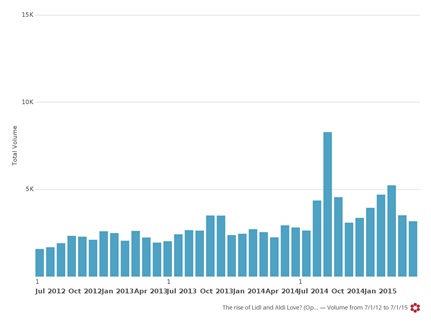

Looking at the social media conversations about online shopping since 2012, not much has changed here either: there?s been no significant spike in people talking about doing their weekly shop online:

At the end of 2014, Waitrose boss Mark Price was quoted saying ?The notion that you are going to go and push a trolley around for the week is a thing of the past?. It seems, in fact, that we still have some way to go before people let go of their trollies.

Top-up Shopping

Katie Hope wrote an article in October 2014 for the BBC entitled ?the death of the weekly supermarket shop? in which she quoted former chief exec of Wickes and Iceland, Bill Grimsey, saying ?In the next 5 to 10 years one of the big 4 could disappear?. This may seem a little premature as our own consumer research shows that 67% of main UK household shoppers are still doing a weekly main shop.

?Top-up? shopping is a phenomenon that the media has claimed is on the rise, but our data doesn?t show any fundamental shifts in this area, with 12% saying they are topping up less frequently, 14% topping up more frequently and nearly three quarters (74%) saying there has been no change in their habits in the last twelve months.

So no clear change is emerging from this data either, but when looking at younger consumers vs. their older counterparts we begin to see a shift?

Young vs. Old

60% of 55+ year olds do a weekly main shop in store. This falls to 46% amongst 18-34 yr olds.

17% of 18-34 yr olds are now doing their weekly shop online vs only 8% of 55+year olds, and a massive 67% of the 55+ group would never consider shopping for their groceries online. So although the shift to online is not shining through right now, as the pre-internet generation declines the rise of online grocery shopping could become a lot more apparent.

So does this mean the end of the out of town Megastore?

Not necessarily.

Indications are that yes, online will grow, but that there is still a role for the big out of town destination stores in the future. And indeed consumers are willing to travel; 50% of shoppers are willing to travel to a store further away than their closest equivalent.

In part, this is likely to be down to cost, but also down to preferred brand.

How do supermarket brands stack-up?

In a recent brand equity project we saw that Tesco is still the strongest brand in the market on the Opinium Brand Strength Index. The big four remain big in terms of brand strength, but only just. Aldi is hot on the heels of Morrisons, with the German discounter performing in line or above the category average, in two of the key areas that drive brand equity: emotional connection, and most importantly for Aldi, being distinguished (standing out from the crowd).

It may be premature to conclude that British shopping habits have fundamentally changed and that one of the old guard is going to follow the likes of WoolWorths & HMV, but what we can be sure of is that the UK grocery battlefield remains as fierce as ever, and giving the consumer what they want in terms of channel & proposition will be the key to success.