The real cost of a bounced Direct Debit

The real cost of a bounced Direct Debit

With 42% of current account holders having paid bank charges*, many of us are familiar with the cost of a bounced (or returned) Direct Debit ? when your bank refuses to honour the payment because you have insufficient funds. Most basic bank account and current account providers charge for this, with some charging up to £25.

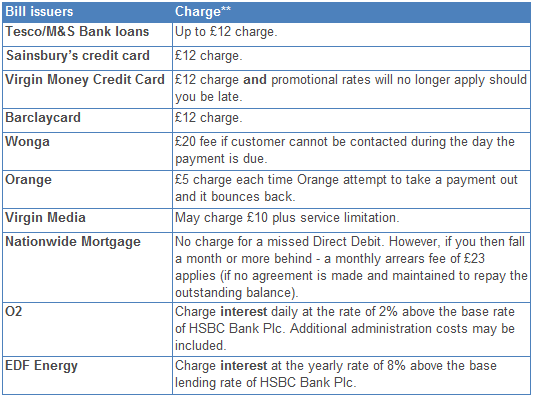

However, this may be just the start of it. In fact, many bill issuers will also charge you for missing a payment. Loan and credit card providers typically charge £12, for example, as our table below shows. What?s less well known is that a missed payment may see you lose any promotional rate (such as a 0% balance transfer offer), potentially adding £100s in interest charges to your bills.

Other firms may also make charges ? such as mobile phone providers, utility firms and pay TV companies. Some charge interest and reserve the right to add unspecified ?admin charges?. Others may limit the service you receive from them. Some utility providers will allow you a couple of missed payments but will then cancel your Direct Debit and you may have to return to a more expensive tariff.

Most lenders report to the credit rating agencies once a month. If a missed payment isn?t caught up quickly then you will find that your credit record will show a missed payment. This will damage your credit rating, potentially making it harder to get credit in the future, or making credit you do get more expensive.

Finally there is the question of catching up with the missed payment. In some cases the provider may wish to take a double payment the following month. In other cases (such as with a mortgage payment) this in itself may be unaffordable. Getting more than a month behind with your mortgage can lead to further charges and action from your lender.

?Missed payments can end up costing you a lot more than you realise,? said Ian Williams of budgeting account provider thinkmoney. ?Although many people are aware that a bank will charge you for returned payments, charges made by the company itself can often prove to be an unwelcome surprise, as can losing access to their services and losing promotional rates or good deals.

?If paying your monthly outgoings on time is something you struggle with, having someone to ensure all your bills are paid on time each and every month could be ideal. Thinkmoney?s Personal Account ring-fences the money to help ensure that all your bills are paid in full every month. What?s more, if you do miss a payment we won?t charge you extra for doing so ? which is one less thing to worry about.?

Providing a built-in budgeting service, the thinkmoney Personal Account comes with a straightforward monthly management fee of £14.50 (£21.25 for joint accounts) ? and no charges for rejected or missed payments.

Here is the link to the full article

* Research carried out by Opinium Research, with an online survey of 2,015 UK adults between 29th and 31st January 2013. Results weighted to nationally representative criteria.

** Based on research of providers’ terms and conditions conducted week commencing 10th June 2013.