Investor Voice – Q2 2025

Investment Performance

Since Q1 there has been a steep (almost -10pp) decline in investors rating the performance of their investments “good.”

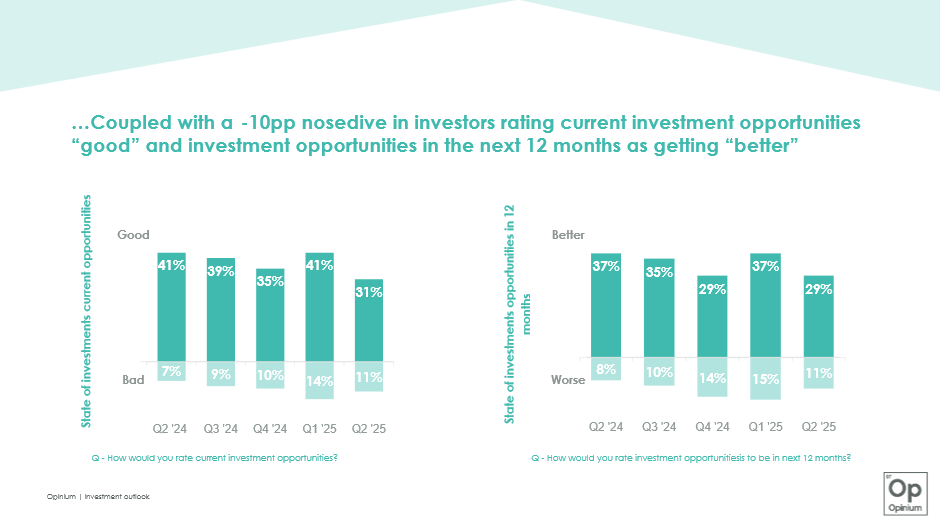

At the same time there has been a -10pp decline in investors saying the state of current investment opportunities are “good,” and that they expect future investment opportunities to get “better” in the next 12 months.

Savings Ratio & Investor Appetite

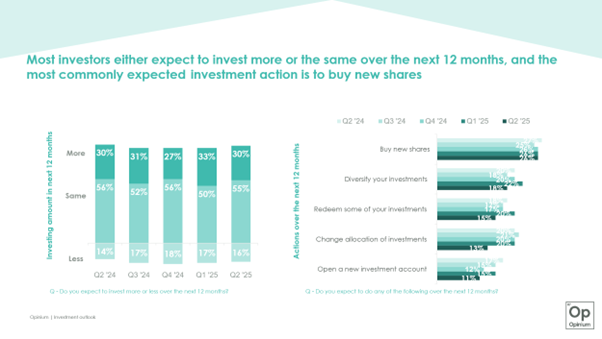

With such negativity about the state of investing now and in the near future, we might expect to see a decline in savings and investment appetite among investors.

However, the reverse is true. The ONS12 reports that the savings ratio has been rising since 2022 and is at a high point since 2010 (excluding data from the pandemic). Our data shows that investors are more likely to expect to increase both their savings and their investments over the next 12 months than to decrease them. Furthermore, of all the investment actions investors expect to take in the next 12 months, buying new shares remains the most common, while few expect to redeem some of their investments.

The Fear Factor

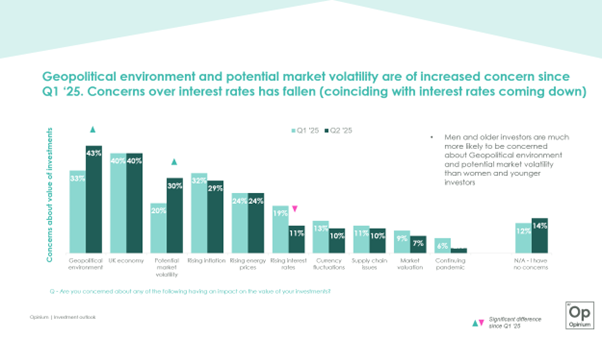

Most investors (86%) hold at least one concern about things that could impact the value of their investments. Concerns about the geopolitical environment and potential market volatility have increased by double digits since wave 2, making geopolitical concerns the top investor concern and moving market volatility into the top 3. The UK economy remains the second top concern, unchanged since Q1.

Recent events since Q1, such as the US tariffs, strikes on Iran (against the backdrop of the continuing war in Ukraine and Gaza), as well as rising unemployment and falling confidence in the Labour government closer to home, are likely to be weighing on the investor mindset and reducing their expectations around investment opportunities. At the same time, the potential fear factor behind these events is also likely to be contributing to the drive among investors to save and invest more money to protect themselves in an increasingly uncertain future. The ONS predicts that around half of the increase in the UK savings ratio can be attributed to increased interest rates and fears over unemployment, but predicts that the remainder is likely to be attributed to “geopolitical worries.”

Best Buying Opportunity Uncertainty

As ever tech remains a safe bet. Commodities remain the most popular asset class buying opportunity reflecting the uncertainty of the times. Beyond this, there has been a decrease in investors being able to pin-point to a country or sector as a best buying opportunity and an increase in investors saying they don’t know, again reflecting the uncertainty in investor mindset at the moment.

There has been no US recovery, it remains seen as second to the UK as a best buying opportunity (the UK itself seeing a large decline this month). Asked about the US tariffs, more investors disagreed with a statement that the US tariffs “never really threatened the value of their investments” than agreed with it. However, three in ten UK investors agreed with the statement that it was “a storm in a teacup that’s blown over now.” Reflecting on the US tariffs, investor views are largely mixed and conflicting, with no clear or certain viewpoint.

Targeted Pension & Investment Support

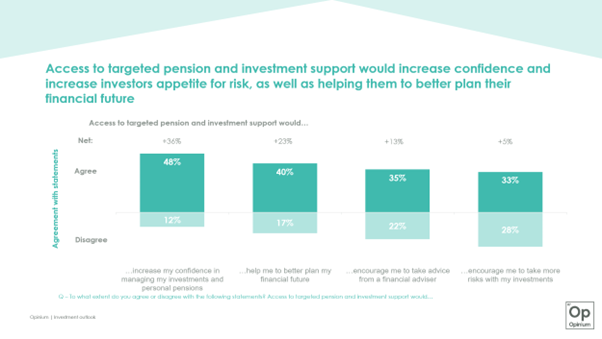

This summer the FCA is due to publish the second stage of its Advice Guidance Boundary Review (AGBR), with a focus on investments. The review recommends that the rigidity of the boundary between advice and guidance be softened, allowing financial services providers to offer “targeted pension and investment support” to unadvised clients, in a bid to narrow the current advice gap. Despite the benefits this could afford consumers, only a third (34%) of UK adults and half (48%) of investors are aware of the AGBR. Only a third (33%) of investors know at least some of the details.

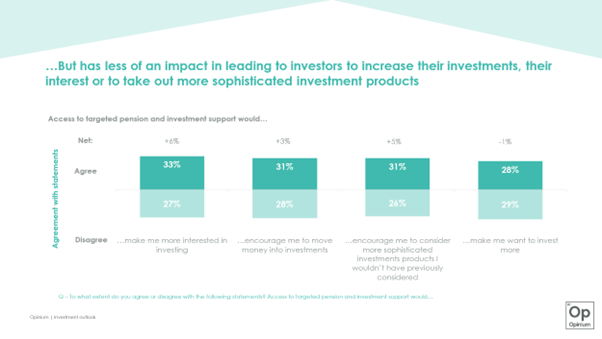

Half of investors (48%) agree that access to targeted pension and investment support would increase their confidence. Two in five investors (40%) agree that it would help them to better plan their financial future, while a third (33%) say it would help to increase their appetite for risk. However, only a quarter (28%) agreed it would make them want to invest more money.

To view the full report, click here: