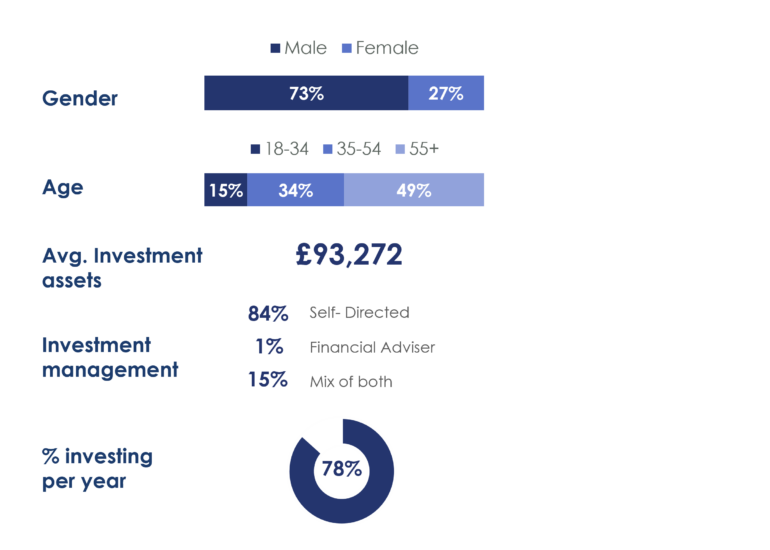

The Growth Hunters

Independent and Strategic

These investors are independent, strategic, and deeply engaged in building long-term wealth.

Experienced Decision-Makers

Typically, older and more often male, they see investing as both a path to financial independence and an intellectual challenge they take pride in mastering.

Self-Directed Risk Takers

Comfortable with calculated risks, they prioritise growth over steady income and prefer making their own decisions rather than relying on advisers.

Research Driven

Researching markets, analysing trends, and managing their portfolios is both essential and personally rewarding.

Sophisticated Investors

They value detailed, data-driven insights over simplified advice and expect content that respects their expertise.

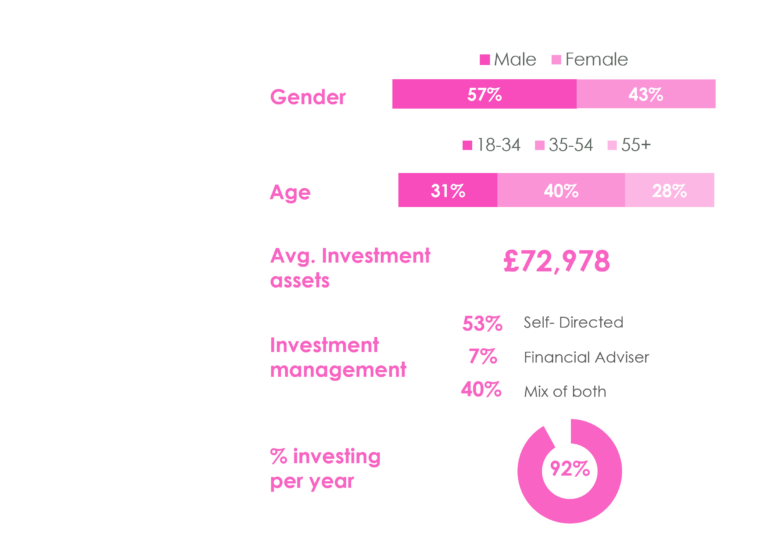

The Bold & Brave Next Gen

Adventurous and eager to learn

These younger, diverse investors are curious and eager to explore new opportunities, seeing investing as both a learning experience and path to wealth growth.

Bold and comfortable with risk

Comfortable with calculated risk for higher returns, willing to take a high risk, high-reward approach to investing, more willing to embrace crypto.

Social-media the trusted source

They turn to social media platforms for insights, preferring advice that feels personal, relatable, and supported by concrete data.

Knowledgeable and enjoy research

They enjoy exploring different investment opportunities with interest in responsible business practices, considering both performance and principles.

Connection and personal engagement matters

Authenticity and connection matter, they respond better to inspiring content than purely authoritative information, with companies earning loyalty through meaningful engagement.

The Peace of Mind Mob

Seek advice from professionals

This older segment includes a notable proportion of women alongside men who typically seek input from financial professionals for their investment decisions.

Hands-off approach

They prefer a “set and forget” approach, establishing investments and making minimal adjustments over time.

Stability-oriented

Market volatility tends to create anxiety for these investors, which influences their investment style.

Lean towards income assets

Their portfolios show a slight preference for income-generating assets over growth investments, reflecting their desire for predictability and stability.

Lifestyle focused mindset

For this group investing is about achieving personal goals while maintaining peace of mind, allowing them to focus on their lives rather than constantly monitoring financial markets.

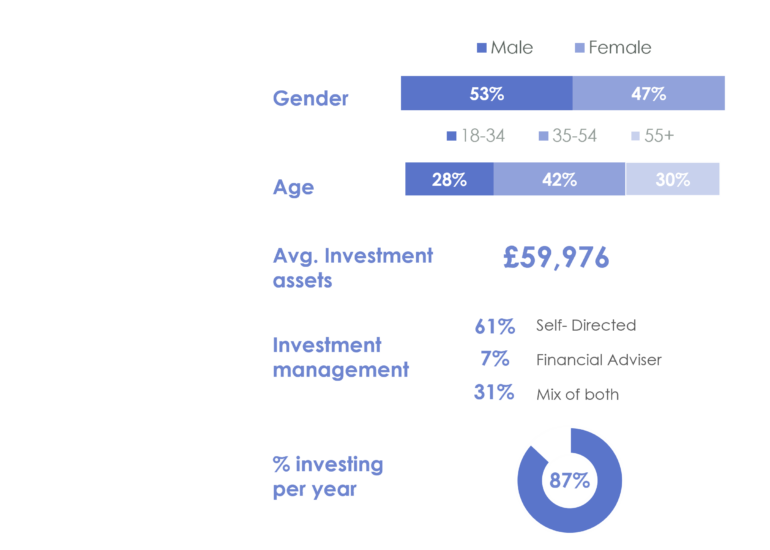

The Short-Term Hobbyists

Diverse and digitally-connected

This group, a younger and gender-diverse investor segment, tends to prioritise short-term financial goals over long-term wealth building.

Pragmatic approach

Their investments are more likely to be a practical tool for achieving near-term aspirations rather than securing distant financial stability.

Social media and data driven

They typically make independent decisions, favouring social media and digital platforms over traditional advisers for investment insights.

Values-aligned choosers

Sustainability appears to be a key consideration, with a tendency to favour companies demonstrating strong environmental and social practices.

Still figuring out their path

Part of them is still figuring out what type of investor they are; they don’t have the confidence of other groups.

The Experienced High Rollers

Building for life scenarios

This typically older, male group approaches investing with diverse goals – funding career transitions, building inheritance, maintaining lifestyle, and securing retirement.

Guided risk-takers

These investors are comfortable with investment risk in pursuit of higher returns, yet prefer making decisions with expert input from financial advisers.

Hands-off after setup

Once investments are established based on professional recommendations, they typically adopt a hands-off approach with minimal adjustments.

Education-focused

This group shows a stronger preference for educational content compared to other segments.

Experienced and calm

They’ve been investing for a long time and are prepared for market fluctuations and are building for the long-term.

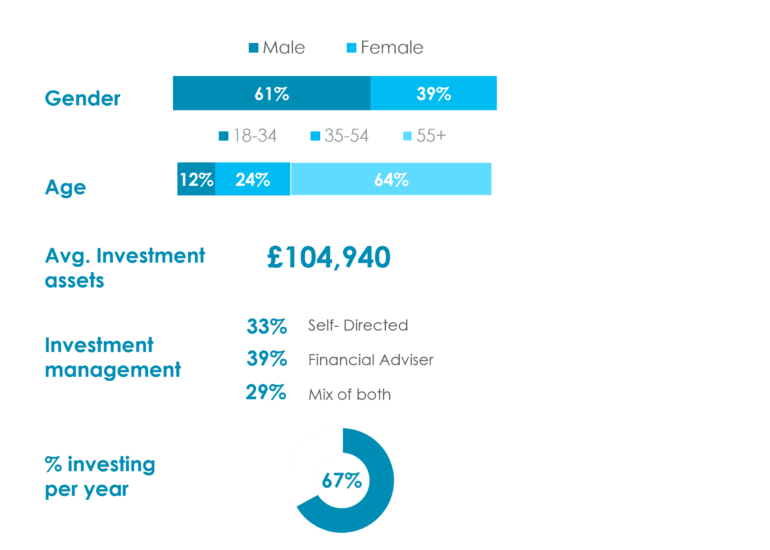

Methodology

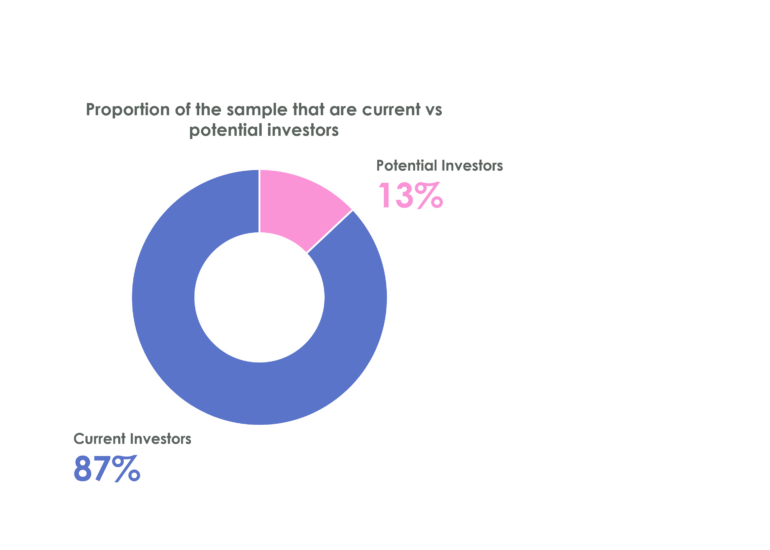

We surveyed 2,000 UK investors who currently hold investments or are considering investing in the next 12 months.

Fieldwork was conducted in April 2025.

15-minute online survey covering:

1. Demographics & profiling

2. Investment attitudes and behaviour

3. Investment goals

4. What investors want from providers

5. Communication preferences

We used cluster analysis to segment the investor audience into five core tribes based on their attitudes and behaviour.

We also used synthetic personas based on LLM to to provide more in-depth qualitative insight into the specific segments we identified in the quantitative research.

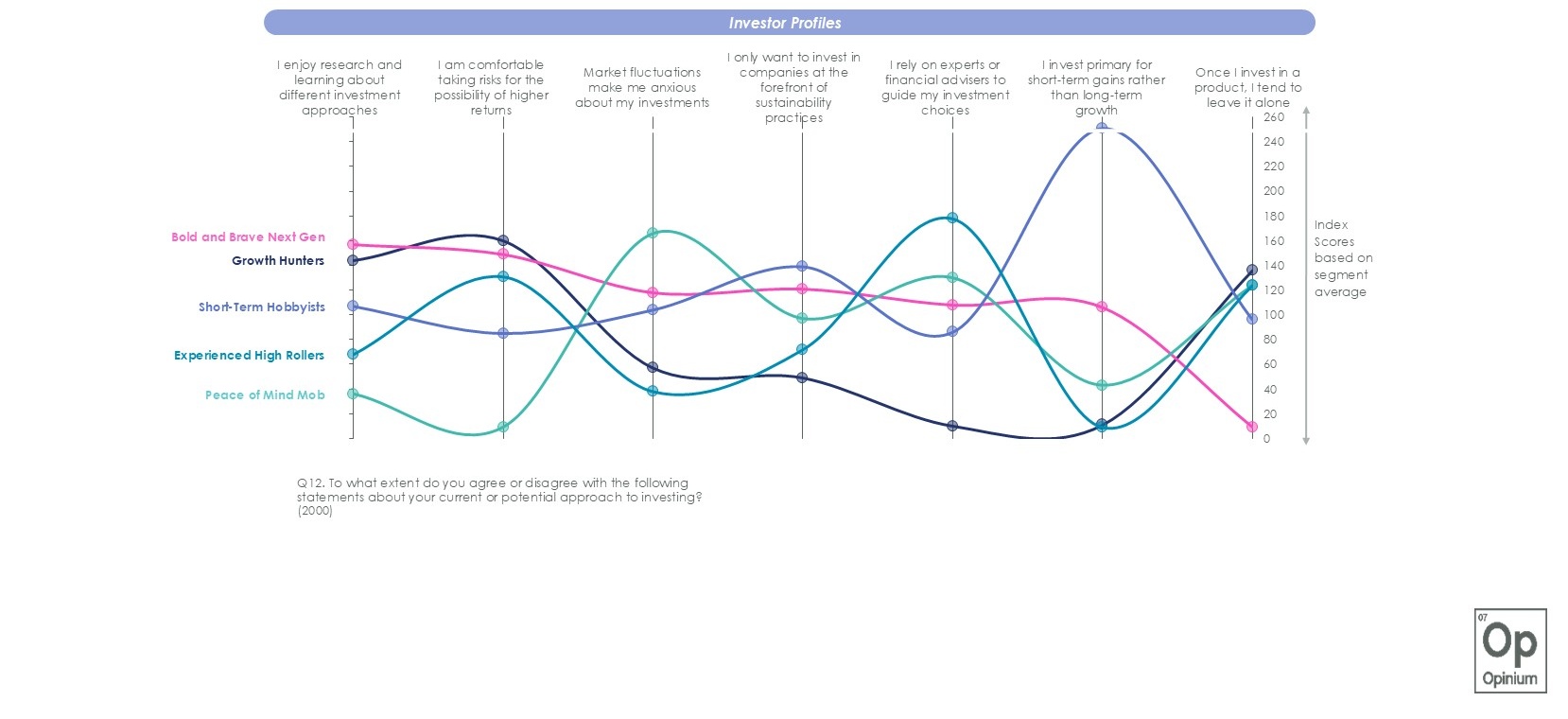

The defining factors that pull each segment apart: